Although most businesses use accounting software to manage their finances, many accounting processes are still manual. Accounts receivable staff create invoices from sales orders. Accounts payable personnel match invoices to purchase orders to validate payments. Without automation, information is copied from one system to another.

These manual processes are labor-intensive and time-consuming. Organizations may have separate systems for sales. A sales order system may have a product catalog plus customer data for generating a complete record of a sale. However, if it doesn’t integrate with the accounting software, data is transferred by retyping the information, increasing the chance of error.

The manual processing of accounts payable requires more than retyping invoice data into the accounting system. It also means verifying the payment information, matching the invoice to a purchase order, tracking the transaction, complying with regulations, and reconciling with the general ledger. It’s no wonder that companies can take more than two weeks to process an invoice from receipt to payment.

Costs for processing a single invoice can range from $12.00 to $35.00 (US), with an average of $18.00 per invoice. Invoice processing can cost large corporations with complex systems as much as $440.00 per invoice. Reducing the resources required for invoicing processing through automation can lower the per-invoice cost. However, it is only one of many benefits of accounts payable automation.

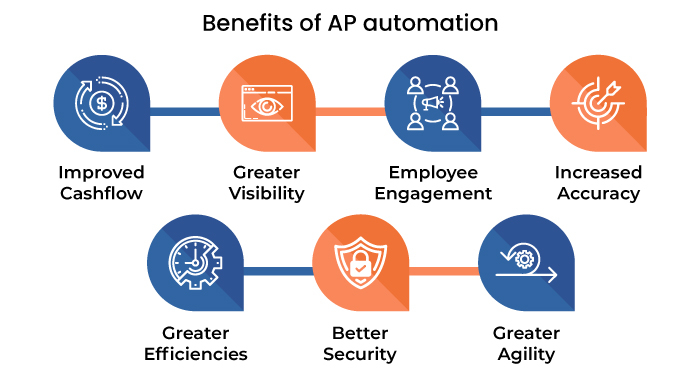

Accounts Payable Automation Benefits

Many organizations recognize the importance of digital transformation to their long-term survival. They must deploy solutions that provide the agility to remain competitive. Automating accounts payable delivers increased agility while improving accuracy and process visibility. Incorporating accounts payable automation best practices ensures companies can realize the following AP automation benefits.

Improved Cashflow

With automated accounts payable systems, businesses can ensure invoices are paid according to vendor terms while maintaining as much liquidity as possible. Taking advantage of vendor-offered discounts for prompt payment of invoices can keep more cash on hand. However, many companies cannot take advantage of the discounts for prompt payment of invoices because their invoice processing takes too long. With automation, processing time can be reduced to two or three days, allowing organizations time to take advantage of discounts.

Greater Visibility

Automated systems that utilize RPA and BPA capture data that can be analyzed. Tracking key performance indicators (KPI) is an example of AP automation best practices. KPIs may include invoice processing expenses as average time to payment, payment errors, and discounts received. Companies can track invoice processing expenses as a percentage of revenue as well as the cost per invoice.

Automated systems collect and centralize data to keep AP teams informed. For example, placing purchase orders into a shared database or repository makes it easier for teams to generate reports to help forecast workloads. Sharing data lets staff correlate invoices to purchase orders quickly. There’s no need to search electronic files to locate a specific sales order.

With custom dashboards for generating reports, users have real-time visibility of the entire AP process, including KPI metrics. An intuitive and interactive interface allows users to review data for improved insight into workflow performance. With greater granularity, companies can tweak AP processes to maximize invoice automation benefits.

Employee Engagement

A primary reason for job dissatisfaction is boredom. Nothing is more boring than repetitive, time-consuming tasks such as invoice processing. As boredom takes hold, employees become less focused, and errors occur. As mistakes increase, employees are pressured to improve accuracy. Before long, work is not just boring. It’s stressful.

Stress leads to burnout, which often leads to higher turnover. Disengaged employees are less productive and are more likely to change employers or leave the job market completely. Keeping employees engaged is essential to worker retention.

A recent study found that 38% of workers experienced burnout in 2022. That is a little over a 3% increase from 2021 and almost a 10% increase over 2020. Of those surveyed, 57% said they were less productive, and 47% said their work was of poorer quality.

Today’s employees have different expectations than before the pandemic. Many are looking for more purposeful work with greater flexibility. If employers cannot meet these changing expectations, employees will look elsewhere. Automation assumes responsibility for these low-value tasks and provides more opportunities for employees to work on higher-value tasks that equate to more purposeful work.

Increased Accuracy

Lowering human error in the workplace can reduce costs, decrease risk, and encourage growth. Yet, research conducted by the Institute of Financial Operations and Leadership in 2023 found that 82% of respondents continue to key invoices into an accounting system, which can easily introduce errors. Accuracy is one of the primary AP automation benefits.

Digital capture of invoices eliminates the need for manual data entry. Information is automatically captured once the invoice is received and transferred electronically into applicable systems. Removing manual data entry reduces human errors that lead to inaccurate processing. A leading manufacturing company was able to reduce errors by 90% with AP automation.

For example, overpayments may occur because invoice information is entered incorrectly or inconsistently. When companies utilize multiple financial applications, each relying on manual entry, duplicate invoices can inadvertently be paid. Accounts payable automation best practices create standardized workflows that improve operational accuracy.

Greater Efficiencies

With fewer human touchpoints, automated invoice processing is more efficient. Payment requests move through the system faster with fewer errors. Approximately 30% of finance professionals spend 50% to 70% of their time collecting, entering, and validating data. Each touchpoint increases the chance of error and extends the processing time.

A multinational consumer goods company was able to reduce manual efforts by 90% and improve turnaround times by more than 85% through AP automation. Consolidating invoice processing allowed the company to manage its accounts payable seamlessly from a central location. It saved processing as well as management time by deploying an automated accounts payable system.

Better Security

Paper-based AP systems have inherent risks. For example, different approvals may be required as the value of the payment increases. Manual systems rely on employees to ensure that approvals are received. An automated system can apply the rules consistently and forward the invoice to the appropriate individual for approval.

Cybersecurity is equally important, and accounts payable departments have become targets. Between 2019 and 2022, the incident of business email fraud rose by 38%. In business email compromise (BEC) attempts, cybercriminals imitate legitimate vendors. They request that electronic payments be sent to a different account number.

As a result, accounts payable may issue the payment to the fraudulent account number, depending on internal processes. The company may not recognize the error until the legitimate vendor asks about payments. In 2022, the average loss per BEC event was $125,000 (US). With automation, a clear workflow for exception processing can be established to reduce potential losses.

Greater Agility

Automation of accounts payable can do more than lower per-invoice costs or reduce cycle time for invoice payment. It can streamline the process from receipt through payment for greater agility. The technology can scale to meet operational demands and adjust to address workload fluctuations.

Automated systems can ingest data from other systems for greater accuracy or read scanned paper-based invoices for digital tracking. Digitized accounts payable means departments can quickly deliver reports to meet internal needs or external regulations. With more agility, companies achieve a competitive advantage.

Realize AP Automation Benefits with Nividous

Nividous uses a holistic approach to automation. Its platform includes all components needed to automate accounts payable processes, allowing for end-to-end visibility for improved management. With Nividous, customers experience the full range of automation benefits without complicated deployment procedures. Request a personalized demo to see how Nividous can help your company realize invoice automation benefits.

![The Path Forward for Intelligent Automation [2024 Trends] Blog Feature](https://nividous.com/wp-content/uploads/2024/05/The-Path-Forward-for-Intelligent-Automation-blog-feature-1.webp)