The Robotic Process Automation (RPA) market is projected to soar to an impressive $50.50 billion globally by 2030. This surge positions RPA as the go-to automation solution across various industries, with the banking sector leading the charge.

The data-intensive nature of back-office processes in banking makes them prime candidates for RPA. By implementing software bots, banks can streamline workflows, achieving significant performance and operational efficiency gains. These automated improvements offer business leaders a compelling value proposition:

- Reduced reliance on manual labor – Free human capital for higher-value tasks by minimizing human intervention in routine processes.

- Faster turnaround times – Achieve greater productivity and reduce errors, leading to quicker processing and improved customer satisfaction.

- Scalability for growth – Easily adapt to changing business demands, ensuring your RPA solution can grow alongside your organization.

- Enhanced accuracy and compliance – Minimize errors and ensure regulatory adherence through precise task execution, leading to higher data quality.

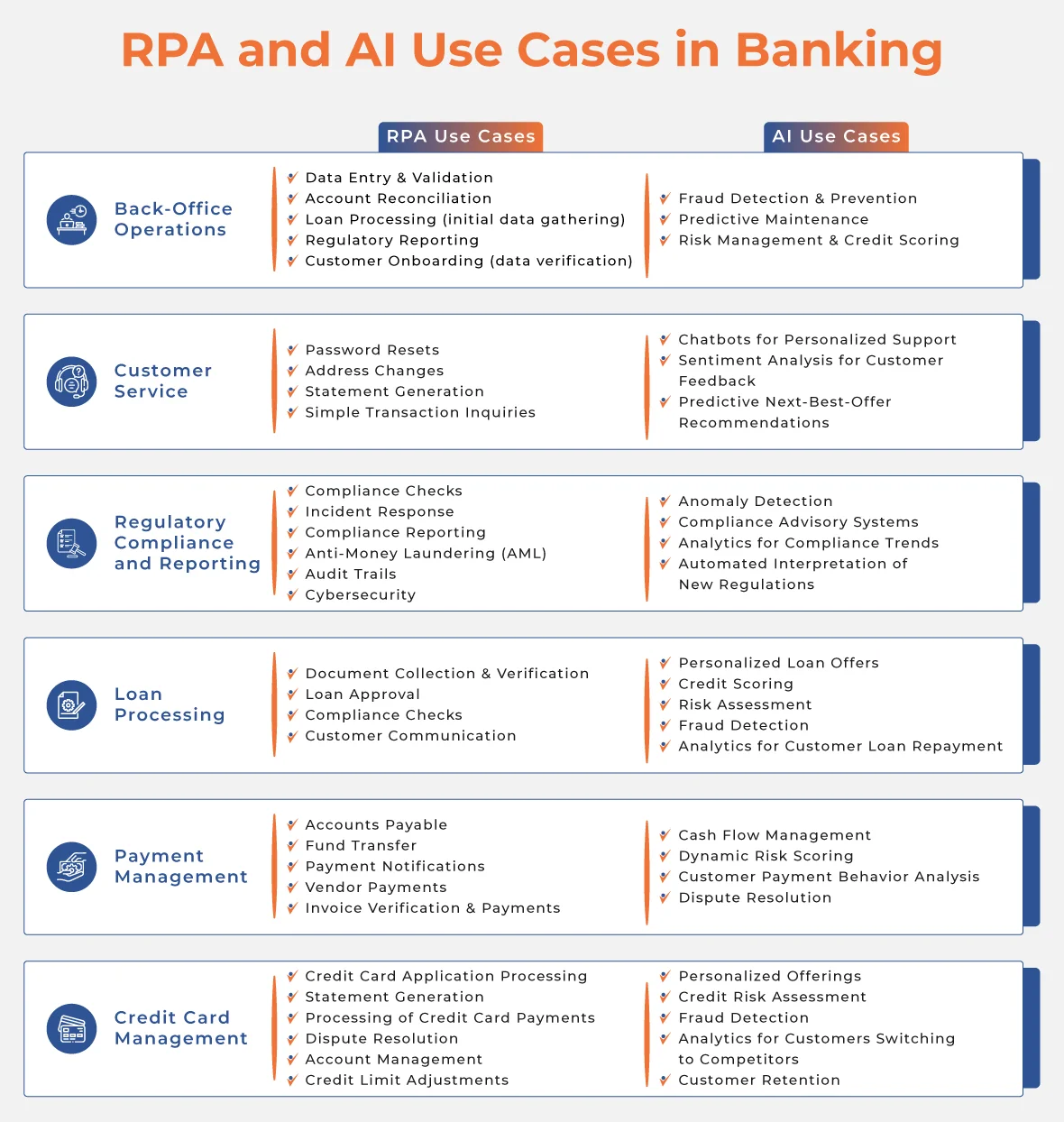

Making RPA Work for Your Bank: Targeting the Right Use Cases

While complete automation might be the long-term vision, focusing on targeted tasks with RPA delivers quick wins and cost-effective improvements. This approach is especially true in banking, where the correct use cases can unlock significant value.

Where RPA shines:

Repetitive, rule-based tasks – RPA excels at streamlining repetitive, rule-driven processes prone to errors. Imagine automating data entry, account reconciliation, or loan application processing – all areas where RPA can significantly boost efficiency and accuracy.

Faster ROI – RPA offers a quicker return on investment. By focusing on well-defined tasks, you’ll see tangible benefits sooner, allowing you to scale RPA adoption across your organization.

Understanding the Difference:

RPA: Think of RPA as a tireless digital assistant that automates well-defined tasks, freeing up your human workforce for more strategic endeavors.

AI: AI, on the other hand, excels at complex analysis and learning. It can uncover hidden patterns, predict trends, and personalize services, ultimately driving data-driven decision-making and superior customer experiences.

By strategically deploying both RPA and AI, banks can achieve streamlined operations with RPA for immediate gains and long-term strategic advantages powered by AI.

RPA Use Cases in Banking

Enhanced Customer Experience

1. Contact Center Optimization – Banks rely on inbound contact centers to swiftly address customer queries. These centers often face a massive volume of inbound calls that are difficult to manage with human intervention alone. RPA tools and chatbots can handle routine inquiries about account statements and transactions, freeing up human agents for complex customer interactions. This human-bot work orchestration leads to faster resolution times and improved customer satisfaction.

2. Customer Onboarding – The customer onboarding process for banks is highly daunting, primarily due to the manual verification of various identity documents. Know-Your-Customer (KYC) involves significant operational efforts for such document validation. RPA combined with AI can automate document verification and data extraction, significantly reducing onboarding time and errors. This translates to a smoother experience for new customers and quicker access to financial services.

3. Personalized Banking – Deliver exceptional customer experiences. RPA Bots analyze customer data to provide tailored advice and product recommendations. This empowers banks to anticipate customer needs and offer proactive solutions, fostering deeper relationships.

Streamlined Operations and Back-Office Efficiency

4. Bank Guarantee Closures -The bank guarantee closure process ideally requires a team of knowledge workers to manually transcribe the data between multiple disconnected legacy systems and identify bank guarantees due for closure/termination/discharge. There are several manual verifications at each stage that deplete the overall productivity. RPA can be used to successfully automate the complete process as demonstrated here.

5. Bank Reconciliation – Several knowledge workers work together to manually analyze transactional data and balance final figures. RPA Bots can be programmed to replace manual efforts with several rules-based automations, including verifying each payment entry against bank data and other records. If the entries are matched, the records are reconciled. However, in case of any discrepancies, the Bots can send the records for further verification.

6. Report Generation – Many banks and financial services providers are utilizing RPA to automate manual tasks involved in report generation. Automating the report generation process includes a range of activities such as:

- Optimizing data extraction from both internal and external systems

- Standardizing the data aggregation process

- Developing templates for reporting, review, and reconciliation of reports

7. Account Closure – Simplify account closure for both banks and customers. The end-to-end account closure activity involves a range of manual tasks such as:

- Checking and verifying documents in the bank’s records

- Sending emails to clients and branch managers

- Updating the data in the system

Automating these tasks reduces the administrative burden and improves customer satisfaction during account closure.

Strengthened Security and Regulatory Compliance:

8. Anti-Money Laundering (AML) – AML analysts typically spend only 10% of their time on analysis. Most of their effort goes into data collection and data organization. The process is highly manual and takes 30 to 40 minutes to probe a single case. These repetitive and rules-based tasks can be easily automated with RPA, enabling more than a 60% reduction in process turnaround time.

9. Audit Trails – Audit trails are crucial for tracing detailed financial transactions for security purposes. RPA tools meticulously record every activity, ensuring accurate and compliant financial processes. RPA automation provides a clear audit trail for regulators and strengthens overall financial governance.

10. Cybersecurity – RPA can automate security checks, detect potential fraud, and integrate with machine learning for advanced threat detection. RPA automation safeguards sensitive customer data and protects the bank from cyberattacks.

11. Regulatory Compliance – Regulatory compliance helps adhere to laws, safeguarding financial stability and integrity within the banking system. RPA is helping banks adhere to laws with lesser manual effort than ever before. RPA tools help mitigate compliance risks through:

- Detailed auditing of transactions

- Accurate data gathering and reporting

- Timeliness in getting critical financial processes up-to-date for compliance checks

Improved Loan Processing and Payment Management:

12. Loan Application Processing – Documents for loan and appraisal requests are received in the form of bundled PDFs via email. Data extraction from applications and verification are some of the key manual tasks. RPA Bots with AI capabilities can intelligently extract data, automating a range of these manual tasks.

Watch a demo of the Nividous Platform for automating the loan origination process.

13. Credit Card Applications – RPA allows for the issuance of credit cards to customers within hours. RPA Bots can navigate through multiple systems with ease to:

- Validate customer data and transactions

- Conduct several rules-based background checks

- Approve or disapprove the application

14. Accounts Payable – RPA tools can be used to automate invoice processing and speed up payment cycles. This helps enhance vendor relationships while consolidating cash flow. RPA helps maintain detailed transaction records that further contribute to compliance measures.

15. Fund Transfer – RPA bots can facilitate the seamless movement of money between accounts, supporting both personal and business financial transactions. Pre-determined rules help automate transfers on a periodic basis—RPA Bots check the availability of funds, perform transactions, and send alerts on customer charges.

Are you ready to transform financial services with AI and automation?

Watch our expert-led on-demand webinar to learn how AI and intelligent automation are transforming payment processing.

The Future of RPA in Banking

RPA has transformed the way banks operate. However, RPA has its limitations. As briefly touched upon in the beginning, RPA struggles with complex decision-making and unstructured data. This is where AI comes in, ready to take automation to the next level.

We’re witnessing a fascinating shift towards Intelligent Automation, a collaboration between RPA and AI. This dynamic duo leverages AI’s learning and analysis capabilities to inject intelligence into automation.

Imagine an RPA bot seamlessly processing loan applications while an AI engine simultaneously analyzes creditworthiness using sophisticated algorithms. This is the power of Intelligent Automation.

The future of RPA in banking isn’t about replacing it with AI. It’s about harnessing the strengths of both. This powerful combination equips banks to navigate the ever-changing financial landscape with greater efficiency, agility, and customer focus. By embracing Intelligent Automation, banks unlock a new era of financial services built on a foundation of speed, accuracy, and security.

Drive Innovation in Banking with the Nividous Intelligent Automation Platform

Nividous partners with banks worldwide to deliver solutions for unique challenges in the financial sector. Our Intelligent Automation (IA) platform leverages a powerful combination of RPA, AI, and Low-code Process Automation (LPA) to drive significant efficiency gains.

Here’s a breakdown of how these components work together:

Nividous RPA Bots – Automate repetitive tasks governed by clear rules.

Nividous Smart Bots – Utilize Intelligent Document Processing (IDP) and AI to extract data from semi-structured and unstructured documents.

Low-code Process Automation (LPA) – Facilitates seamless collaboration between humans and bots through an intuitive interface, ensuring a smooth human-in-the-loop experience.

Our banking customers have seen a significant return on investment (ROI) within months. This translates to:

- Lower total cost of ownership

- Improved process throughput

- Enhanced auditing and compliance

- Better experiences for both employees and customers

By embracing Nividous’ Intelligent Automation Platform, banks can unlock a new era of innovation and efficiency.

Fast-Track Your Automation with our Quick Start Program!

Get a trained Nividous Bot into Production in 3-4 Weeks.

Click any term below to learn more.

Intelligent Automation

The seamless integration of RPA, AI, and workflow automation tools to automate complex, end-to-end business processes for higher efficiency and agility.

RPA (Robotic Process Automation)

Software bots that replicate human actions to perform rule-based, repetitive tasks with speed and accuracy.

Agentic AI

An advanced form of AI that autonomously makes decisions and takes actions to achieve defined goals without human intervention.

Generative AI

AI models, such as ChatGPT and Gemini, that can create original content—text, images, or code—based on natural language prompts.

Low-Code Platform

A visual development environment that enables users to build applications quickly using drag-and-drop components and minimal coding.

Hyperautomation

A strategic approach that leverages multiple technologies—including RPA, AI, and low-code platforms—to automate business processes end-to-end across the enterprise.