Imagine a bank sending proactive notifications with personalized savings tips aligned with a customer’s financial goals. Powered by Generative AI, this thoughtful gesture is just one of many groundbreaking solutions revolutionizing banking.

So, what makes generative AI (GenAI) effective in banking?

GenAI is an advanced form of AI that leverages powerful machine learning algorithms to analyze and process vast datasets. These algorithms reveal patterns used to create complex and real-life financial outputs.

GenAI technology can mimic human decision-making, enabling banks to deliver personalized and context-aware solutions to customers. At the same time, it enhances operational efficiency and reduces risk while fostering innovation across banking processes.

Breaking Down the Building Blocks of a GenAI Solution

Let’s explore the four core components of a banking application, using a hypothetical Generative AI tool called LoanGenie as an example. The first 3 components below train LoanGenie on real-time, complex financial datasets before it is ready for deployment:

1. Data Processing Layer

The bank gathers customer data such as account history, credit scores, and spending habits. This data is carefully organized so LoanGenie can understand it and work accurately.

2. Generative Model Layer

LoanGenie’s advanced AI algorithms analyze organized data to reveal patterns, such as which customers are likely to need a loan. The algorithms then use the data to generate tailored loan recommendations that meet individual customer needs.

3. Improvement and Feedback Layer

LoanGenie gets smarter over time by learning from feedback when customers accept or decline loan offers. This makes the recommendations more accurate and useful.

4. Integration and Deployment Layer

Once LoanGenie is ready, it is integrated into the bank’s app or website. Customers will receive personalized notifications, such as a home loan offer with customized terms, improving their experience and building trust with the bank.

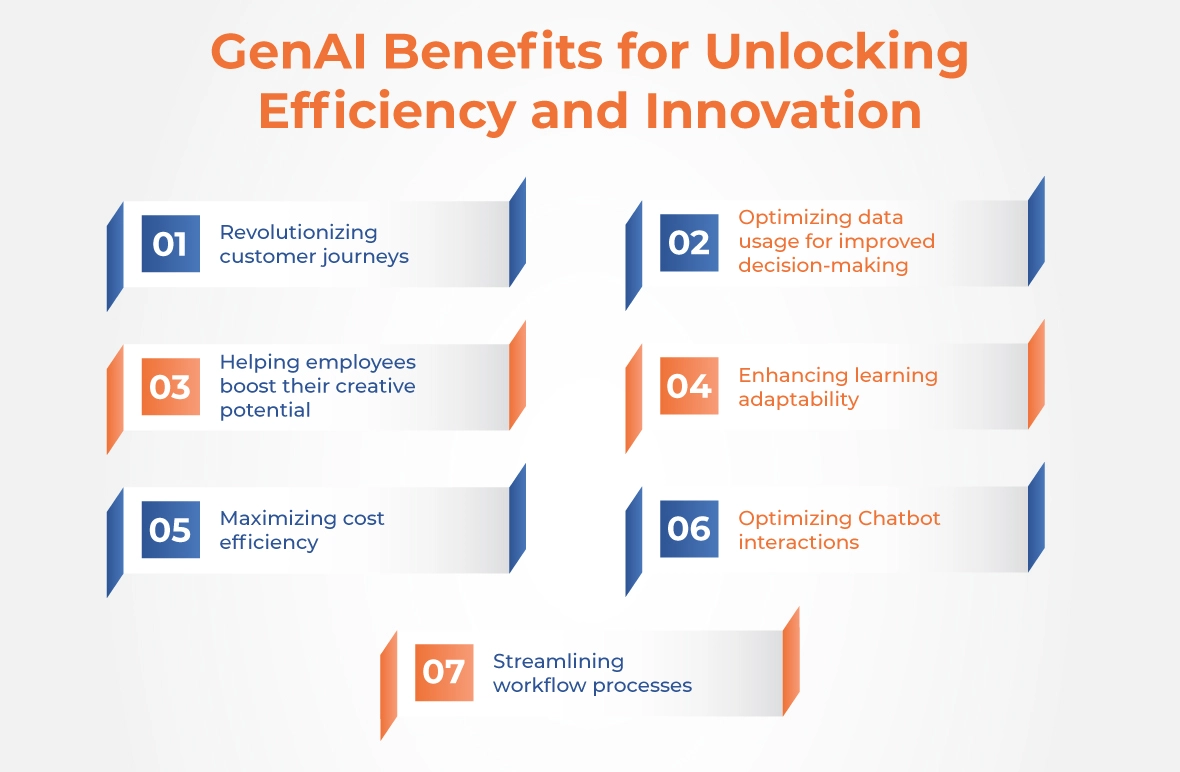

GenAI Benefits for Unlocking Efficiency and Innovation

GenAI enables businesses to unlock new possibilities and stay competitive in the rapidly evolving financial market. Here are some of the benefits associated with GenAI:

1. Revolutionizing customer journeys

Generative AI tools analyze customer data to provide tailored financial products and offers. Banks can then enhance customer engagement by delivering personalized experiences through dynamic communication channels.

2. Optimizing data usage for improved decision-making

Financial institutions deal with vast amounts of financial data and knowledge. A GenAI tool can categorize these assets for faster access, supporting better decision-making and research.

3. Helping employees boost their creative potential

Banks can use GenAI to mass-produce innovative content such as marketing materials and customer communications. A highly-enhanced level of creativity can be achieved, transforming how banks engage with clients and market their services.

4. Enhancing learning adaptability

A GenAI solution continuously learns and adapts based on new data and feedback. This allows GenAI models to boost their performance over time and generate outputs that align better with user preferences and objectives. For instance, in personalized banking, GenAI models can dynamically adjust financial goals to match each customer’s needs and preferences, enhancing the effectiveness of advisory experiences.

5. Maximizing cost efficiency

GenAI can optimize operational costs by automating tasks such as document generation and compliance checks. This leads to cost savings and more streamlined Generative AI-enabled financial services.

6. Optimizing Chatbot interactions

GenAI-powered Chatbots use natural language processing (NLP) to provide real-time recommendations that are personalized assistance, improving the overall customer experience.

7. Streamlining workflow processes

GenAI improves banking operations by automating complex workflows, such as fraud detection and loan processing. This leads to more efficient resource allocation and higher staff productivity.

GenAI in Practice: Examining Real-World Use Cases

Here’s a look at Generative AI use cases in banking that depict how it is transforming financial institutions:

| Use Case | Role of GenAI |

| Wealth Management |

|

| Anti-Money Laundering (AML) |

|

| Fraud Detection |

|

| Credit Risk Assessment |

|

| Loan Underwriting |

|

| Lead Generation |

|

| Debt Collection |

|

| Document Processing |

|

| Report Generation |

|

| Tax Process Automation |

|

Nividous GenAI Success Stories

| Client 1: A leading firm ranked among the USA’s top lenders. |

| Challenge: Overworked staff dealing with more than 5000 loan applications per month and 50 million pages per year. The staff struggled to interpret and extract data for comparison with internal systems. |

Solution: We offered a comprehensive solution featuring Intelligent Automation and GenAI to:

|

Results:

|

| Client 2: A leading provider of loans. |

| Challenge: The lending process faced significant inefficiencies due to a Loan Origination System (LOS) lacking API integrations. Staff spent excessive time manually sorting emails, verifying creditworthiness, and comparing data, leading to delayed workflows and increased operational burden. |

Solution: We created a GenAI-powered platform that offers the following:

|

Results:

|

The Nividous Approach for Accelerating Generative AI Integration for Banks

Nividous focuses on resolving key challenges in your financial institution’s digital transformation journey. We address issues like high operational costs and fragmented process automation by providing a comprehensive platform that leverages GenAI along with native AI/ML, IDP, low-code/no-code automation, and RPA.

- Nividous Studio: Accelerates workflow design with reusable, draggable components.

- Nividous Control Center: Manages and scales AI-driven digital operations through a powerful dashboard.

- Nividous RPA Bots: Integrates with GenAI to deliver error-free, flexible automation across interfaces.

- Nividous Smart Bots: Combines the strengths of Generative AI and RPA to handle complex documents with ease using Predictive Analytics, Natural Language Processing (NLP), and Intelligent Document Processing (IDP).

Unlocking the Power of Generative AI: Transforming Banks and Beyond

Watch our on-demand webinar to discover how Generative AI is reshaping not only banks but also other industries by streamlining processes and driving innovation across departments.